Absolutely. How can we call ourselves THE LAND OF THE FREE with a straight face if we have to pay what is effectively rent on land we obviously don’t really own?

True ownership, true freedom, means you pay for it once and it’s yours forever. And that includes the right to deed it to your decendants.

That’s absurd. And anti-American. It’s the antithesis of freedom. Say you’re 50 40,30 whatever, you worked your whole life up until then to buy land. You build you house on it Thoreau style. Why should you pay again and again every year under threat of having that taken away from you?

Hell no. Pay once and done. It’s not a lease.

County appraisers have raised the value of my property to a ridiculous level. It’ll never sell for ehat they say its worth. I own my property now, but I’m paying moar in taxes per year than I paid rent when I was renting. Only an oppressive government would do this. Paying rent/tax for life or you lose your home is economic slavery.

16k a year here, and it’ll only increase next year. Property tax is a zero sum game. We lose 100% of the time.

I did not sign up to rent property from the Government for my entire life.

Property taxes are theft.

I agree with the sentiment. But if you recall, Article 1 Sec. 8 of the U.S. Constitution enumerates all of the powers We the People gave the federal government. Regulating property tax (including the power to ban such things) is not a legitimate federal power. The 10th Amendment expressly gives all unenumerated powers to the states and to the people. In other words, this is an issue that would require a constitutional amendment to federalize. Without super-majority support from the states, such an amendment will not be ratified. It is currently a state matter.

Note: This should only be for someone’s primary residence. Not on all of their houses if they have more than one, the rest should have property tax on as they are most likely in a stable financial position. An argument could also be made to keep property tax for residential properties used as a business or owned by a company

In Progress and Poverty, Henry George makes a cogent argument that poverty arises, even in the face of technological progress, due to the hoarding of natural resources, primarily land. If taxes were levied only on parcels that exceeded the average size, then fewer speculators would hoard land and more land would be available at lower prices so that most people could afford a piece of land, on which to live and garden, and they would not be in danger of losing it to the town for unpaid taxes in their retirement.

But the town still needs taxes for public infrastructure. This has got to come through the US Treasury in the form of Greenbacks, such as President Lincoln issued. Creating new currency to be converted into public infrastructure, for which the people pay fees to use, does not create inflation as debt-backed currency does.

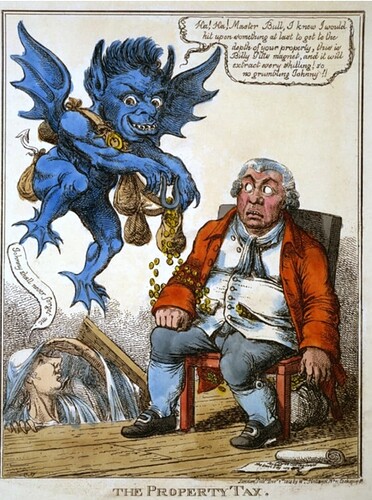

The founders of our country forbade property taxes. Property is an extension of yourself and should not be taxed. Here’s a political cartoon from the 1800s against property taxes.

Go a step further. Not only end property tax but make it illegal.

Property tax is very wrong on a fundamental level. If you stop paying they will confiscate what the Bill of Rights garuntees. That is criminal and here is why:

“…nor be deprived of life, liberty, or property, without due process of law; nor shall private property be taken for public use, without just compensation.”

The fifth amendment. No one is ever compensated for their property taken by property tax.

And by that we can also clearly see that property tax was never enacted based off of what is written in the fundamental law of the land. For any novice lawyer with an elementary understanding of the Bill of Rights would know that by taking American citizens property without compensation they were already commiting a treasonous act. The rest of the concept should NOT be assumed to have been legislated in good faith for this reason alone despite being many others.

Team Trump Please don’t dismiss this issue. It is most definitely a fundamental part of the disease which begs for a cure.

Colin

This is a state issue not an issue for the federal government. The federal government should not dictate to the states how they tax.

Maybe, but we shouldn’t have to pay a tax indefinitely that also gets passed to family if they inherit the property(another tax that shouldn’t exist) and risk property loss because they can’t or don’t pay it. It should be a tax included in the closing of the property purchase, one and done.

Agree 100%

I don’t think we need to necessarily end them, I think there should just be a cap on them too. They shouldn’t become unaffordable. I do think, though, that they should be ended at the age of 60. The retirement age is SUPPOSED to be 65. Give people a few years to save for retirement and peace of mind when they do retire. Nobody who has worked their way through life should be worried about losing a home they bought 40 50 years prior.

Yes this would help farmers sooooo much too!!

I worry about the potential for this policy to engender a landed gentry. Should we have a sort of standard deduction up to some point and an increasing rate beyond that?

Property taxes on a property shall sunset after 30yrs from the date of sale or change of ownership.

In the 1990s I asked my parents why property taxes existed, and they said it was so people like Bill Gates couldn’t buy all the houses in the USA. Fast forward, and Gates owns all the farmland and Blackrock owns all the homes in the USA.

another idea VERY worth considering is to eliminate ALL taxes EXCEPT for a land tax. this would be a totally voluntary & visible tax.